I love trading during options expiration week. It’s the one time when I have a pretty good idea of which market direction would likely benefit market makers. It doesn’t provide us a guarantee, but, in my opinion, does tilt the ...

The Fed isn’t likely to stop raising rates anytime soon, which means cash is starting to become a viable competitor to the increasingly volatile trading in stocks and bonds. Moreover, liquidity is now reaching very dangerous levels. See below for details ...

After a volatile Thursday and Friday, Monday continued, but, like Thursday, it was again to the upside. As we try to hammer in a bottom here, a few charts stand out. First of all, the banks are starting to behave ...

On this week’s edition of The DecisionPoint Trading Room, after looking closely at the market and new positive divergences on DecisionPoint indicators, Carl opens a CandleGlance of the Dow 30 and discusses which stocks look the most encouraging. Erin dives ...

The 200-week moving average or about 4-years, represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points. Although there is very little written about the 200-WMA, only in ...

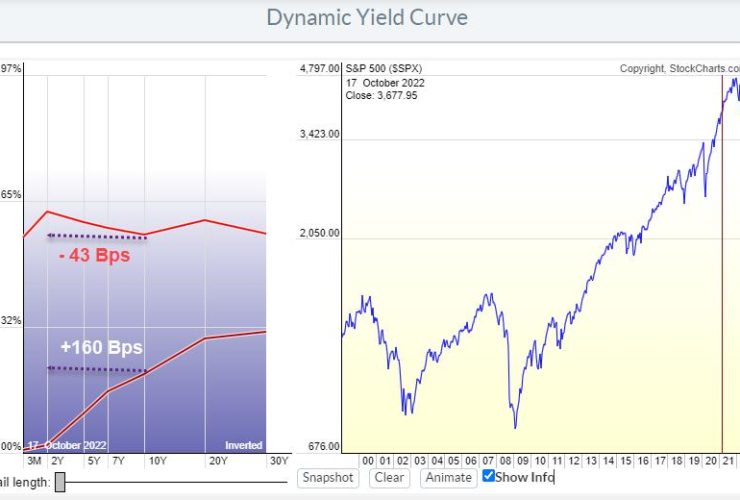

In March 2021, lending money to the US Government for ten years would give you a return of around 1.7%/ann over the next ten years. Lending money to the government for 2 years at the same time, would give you ...

After one week of hiatus, I’m back with a new episode of StockCharts TV’s Sector Spotlight. I’ll be catching up with a refresher on asset class rotation, as well as sector rotation. In the AC segment, I point to the still-inverted ...

The 200-week moving average (about 4 years), represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points. There is very little written about the 200-WMA. But only once, ...

On rare occasions stock indexes become delicately balanced between two profoundly differing scenarios. This currently seems to be one of those junctures. The most recent Power Charting TV episode explores this existential moment. Stock indexes have been in a mega-bullish ...