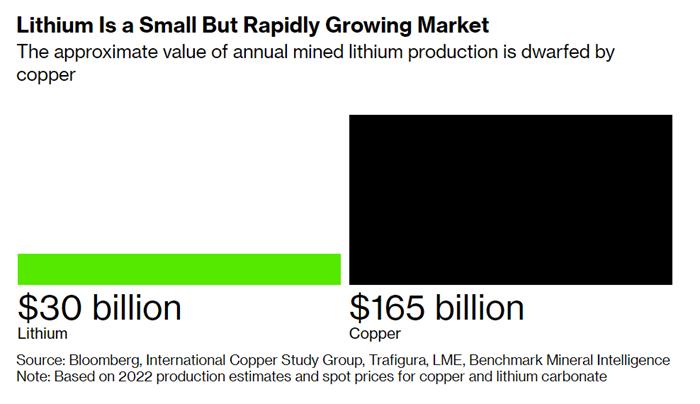

The lithium market is insignificant in comparison to more established commodity markets – yearly global oil output is worth more than $3 trillion at present rates.

The race to secure lithium supplies is on.

While lithium demand multiplies, geopolitical concerns between China and the West have made securing a reliable supply of lithium more difficult. Lithium is becoming one of the world’s most-sought commodities, yet the annual amount globally is still tiny. Battery makers and EV manufacturers have been rushing to lock in supplies. The electrification of transportation, tight supply, and robust EV sales are causing prices to skyrocket.

Do you know the best way to trade Lithium profitably? Or how to position your trading in anticipation of this secular trend?

Global X Lithium & Battery Tech ETF (LIT) broke out above the 50-day MA and is looking to take out the 200-day MA.

The Global X Lithium & Battery Tech ETF (LIT) provides investors access to companies involved in the entire lithium cycle, from mining and refining to producing lithium batteries.

Lithium’s importance to the global economy will only increase in the coming years as we move towards a more electrified world.

LIT is displaying strong price leadership, as seen by the MarketGauge Triple Play Leadership indicator, with the blue line above the red line indicating that LIT is leading the market. LIT also displays improved price momentum in the MarketGauge Real Motion Indicator. The Real Motion Indicator and the Triple Play Indicator aid trading performance by validating price direction and momentum strength.

LIT is an ETF that offers global exposure to the Lithium market, so if you’re looking to position your trading for the future of transportation, consider adding LIT to your portfolio holdings. We expect strong demand coupled with Lithium’s restricted supply to sustain a favorable pricing environment for the foreseeable future.

Contact us today if you want to get started trading and learn how we can help you trade and capitalize on big trends. You can sign up for a consultation with Rob Quinn, our Chief Strategy Consultant, to learn more about Mish’s Premium trading service.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish explains why MarketGauge loves metals and is still patiently loading up equities on Business First AM.

Mish talks metals, rates, dollar, and which sector to buy/avoid in this appearance on UBS Trending.

See Mish talk with Charles Payne on Making Money about the Oil markets testing the limits of Fed policy, China, and what to buy in the metals.

Mish joins Cheddar to talk about some of the fallout from the most recent Fed Meeting.

See Mish join Neil Cavuto and Eddie Ghabour on Cavuto Coast to Coast to talk about the Fed’s recent rate hike decision.

Click here to see Mish and Helene Meisler’s panel at the Trader’s Summit event!

Mish discusses Meta and Palantir and how trends are switching in this appearance on BNN Bloomberg.

ETF Summary

S&P 500 (SPY): 375 support, 383 resistance; same as before.Russell 2000 (IWM): 177 support, 183 resistance; same as before.Dow (DIA): 328 support, 333 resistance.Nasdaq (QQQ): 266 support, 273 resistance.KRE (Regional Banks): 62 support, 65 resistance; same as before.SMH (Semiconductors): 197 support, 204 resistance.IYT (Transportation): 212 support, 217 resistance.IBB (Biotechnology): 127 support, 132 first resistance; same as before.XRT (Retail): 58 support, 63 resistance; same as before.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Wade Dawson

MarketGauge.com

Portfolio Manager