This past week, we have written a lot about tech (another AI-generated photo), the discordance between the small caps and large caps, rates, debt ceiling and the Fed.

For this weekend, we want to invite you to have a listen to the live coaching Mish does exclusively for our MarketGauge members.

In this recording, Mish covers:

IndicesEconomic Modern FamilyMetals and Commodities-Reading Futures ChartsInterest RatesThe DollarRisk on/off Big ViewAI and tech-quants and the beauty of mathThe impact of Nvidia-some obvious-some under the hoodSpecific stock picks with parameters

Click here to get the link for the live coaching, plus receive actionable information on key ETF indices and sectors.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish and Caroline discuss profits and risks in a time where certain sectors are attractive investments on TD Ameritrade.

Powell eyes a pause, Yellen hints at the need for more rate hikes, and debt ceiling talks face challenges… what a way to end the week, as Mish discusses on Real Vision’s Daily Briefing for May 19th.

Mish provides a roundup of the commodities and currency pairs to watch this week on CMC Markets.

Mish explains how the Retail ETF is at a critical level on Business First AM.

In this video, Mish walks you thru the Dollar, Euro, GBP, Gold, Silver and more.

Mish walks you through the fundamentals and technical analysis legitimizing a meme stock on Business First AM.

Coming Up:

May 31st: Singapore Radio with Kai Ting 6:05pm ET MoneyFM 89.3

June 2nd: Yahoo Finance

ETF Summary

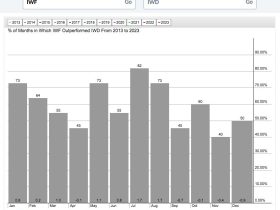

S&P 500 (SPY): 23-month MA, 420 support, 410 held.Russell 2000 (IWM): 170 support-180 resistance.Dow (DIA): Right down to its 200-DMA and a confirmed caution phase.Nasdaq (QQQ): Worst case, a potential reversal top on weekly chart; best case, gets thru the weekly highs.Regional banks (KRE): Did the initial damage, now sidelining.Semiconductors (SMH): No doubt she is showing expansion.Transportation (IYT): Like to see this hold 220 this week.Biotechnology (IBB): 121-135 range.Retail (XRT): 56.00 the 80-month MA while momentum is at least flatlining.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education