Chinese clean energy hardware maker EcoFlow Technology Inc. is exploring a potential initial public offering in the US, according to people familiar with the matter.

If it moves ahead, the listing would stand out at a time when few Chinese companies of comparable size have tested US capital markets.

The plans, as reported by Bloomberg, remain early-stage and subject to regulatory clearance in China, but they underline a selective reopening of overseas fundraising channels.

For EcoFlow, which has built a global business around portable power and energy storage products, a US listing could provide fresh capital and broader investor exposure, even as cross-border listings remain politically sensitive.

US IPO plans take shape

EcoFlow is working with advisers on a possible US share sale and could raise at least $300 million, according to Bloomberg.

The company is backed by HSG, formerly known as Sequoia Capital China, which has supported several high-profile Chinese technology firms.

The timing of any offering will largely depend on when China’s securities regulator grants approval.

That step has become a critical gatekeeper for overseas listings since Beijing tightened scrutiny following regulatory disputes tied to foreign share sales.

While Chinese firms have continued to list in the US this year, most deals have been small or completed through special purpose acquisition companies rather than traditional IPOs.

Business model and global reach

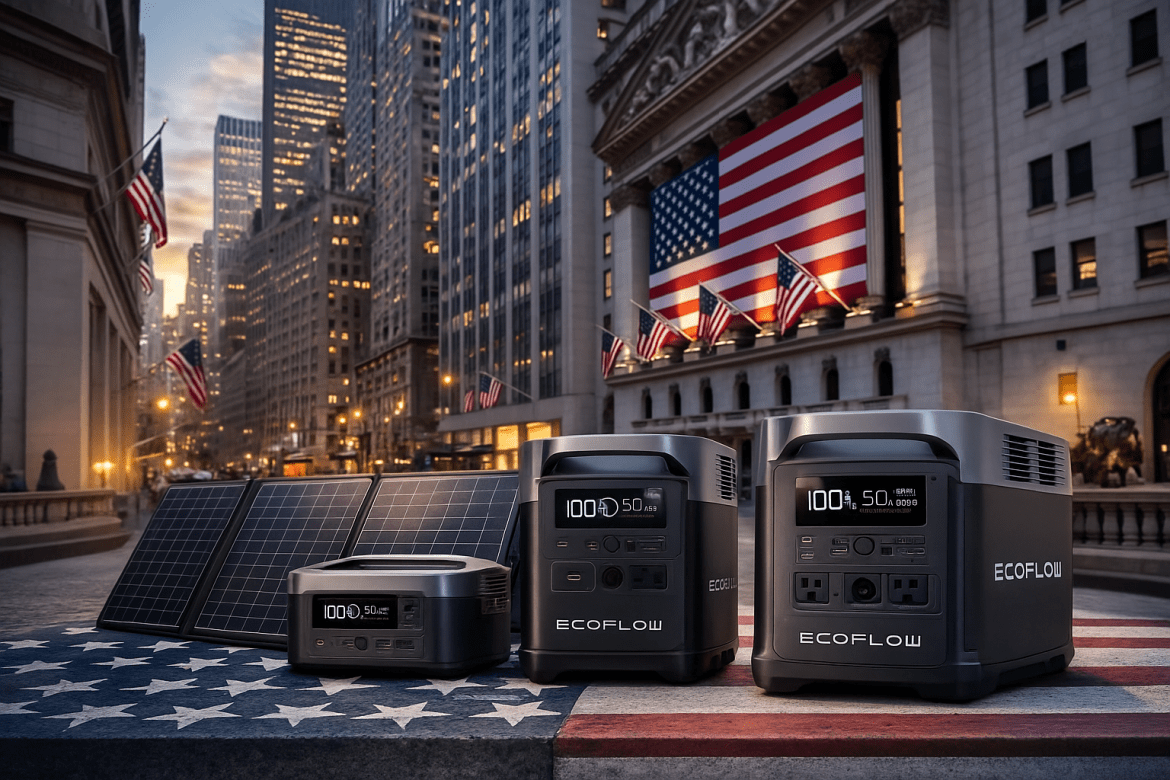

Founded in 2017 by a group of battery engineers, EcoFlow focuses on portable power stations, solar panels, and power banks.

Its product range also includes portable household appliances such as freezers and air conditioners, positioning the company at the intersection of consumer electronics and clean energy solutions.

The firm has gained recognition at the national level. Beijing has designated EcoFlow as one of China’s so-called little giants, a label given to technology companies with specialised capabilities and global competitiveness.

That status reflects the government’s emphasis on advanced manufacturing and energy-related technologies.

EcoFlow’s products are marketed internationally, and its growth has been tied to rising demand for off-grid power, outdoor energy solutions, and backup electricity for homes and businesses.

Funding history and valuation

EcoFlow last raised significant capital in 2021, securing more than $100 million from investors including HSG, Hillhouse Investment Management Ltd., and China International Capital Corp.

At the time, founder Bruce Wang said the round valued the company at several billion dollars, notes Bloomberg.

During that period, EcoFlow had been targeting a domestic listing in Shenzhen.

The shift toward a potential US IPO marks a change from those earlier plans and highlights how market conditions and regulatory considerations have evolved since then.

A narrow window for Chinese listings

US IPOs by Chinese companies have slowed sharply since the 2021 listing of ride-hailing firm Didi Global Inc., which triggered a regulatory crackdown in China on overseas share sales.

Since then, the risk of Chinese firms being removed from American exchanges has lingered amid broader geopolitical tensions between the US and China.

So far this year, the largest US IPO by a Chinese company was completed by tea chain Chagee Holdings Ltd. in April.

EcoFlow’s possible listing would therefore represent one of the more substantial attempts by a Chinese private company to tap US public markets in the current environment.

The post EcoFlow weighs US listing amid cautious Chinese IPO revival appeared first on Invezz